Secure & automated IVR

phone payments

A fully automated payment collection system, available 24/7

- Fully branded and bespoke to your brand image

- Process payments at any time, 24 hours a day - 365 days a year

- The service typically pays for itself within 3 months

- Multiple flows allow one solution to be used across various departments

Your solution will be fully branded and bespoke to you, with professional voice artist recorded messages included.

Multi-lingual and multi-currency support is also available.

2 Payment IVR connectivity options…

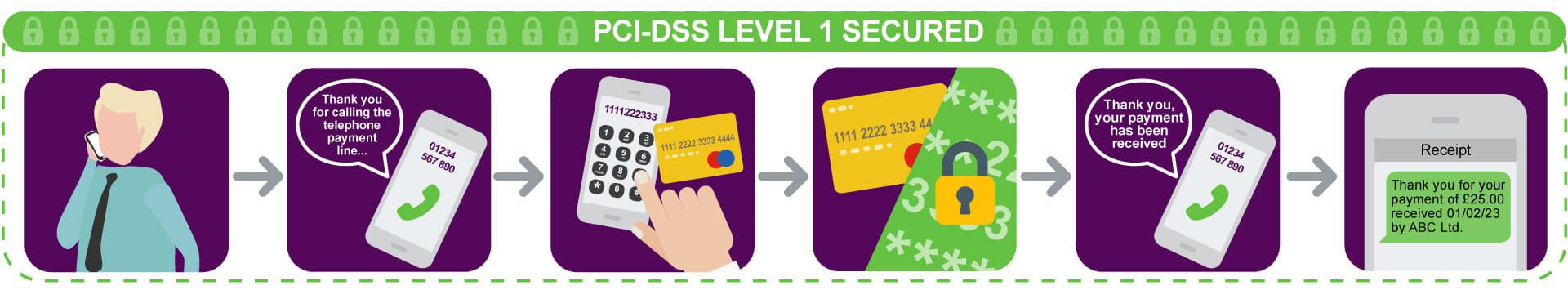

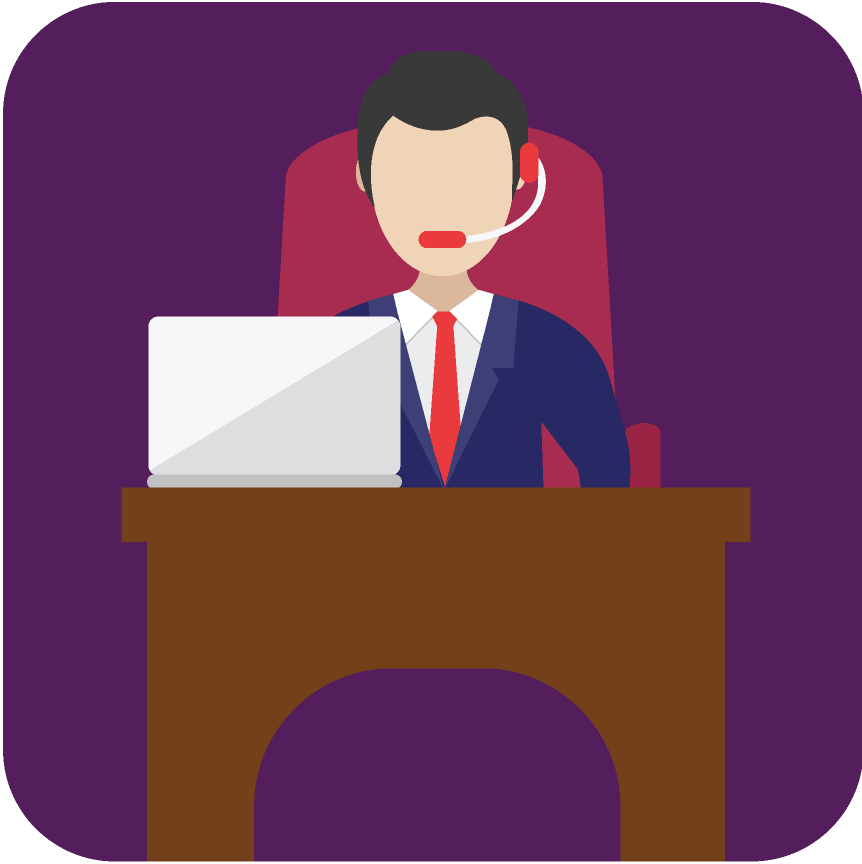

There are two ways for a Customer to make a PCI-DSS compliant payment with our IVR Solution.

Your solution can be configured to suit your business needs, all fully secure to the highest level of PCI-DSS compliance.

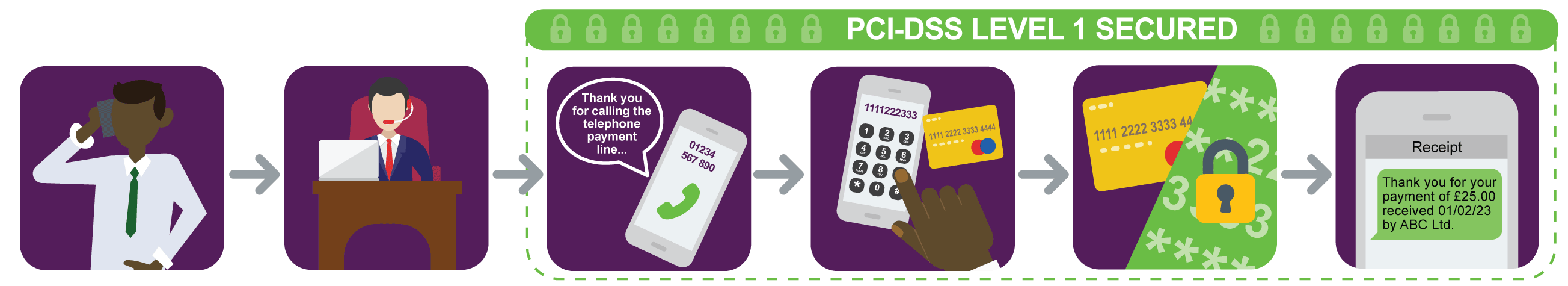

1

The customer calls the organisation to make a payment.

2

The customer is greeted by an automated line which asks a number of security questions. After verifying their identity, they are taken to the payment stage.

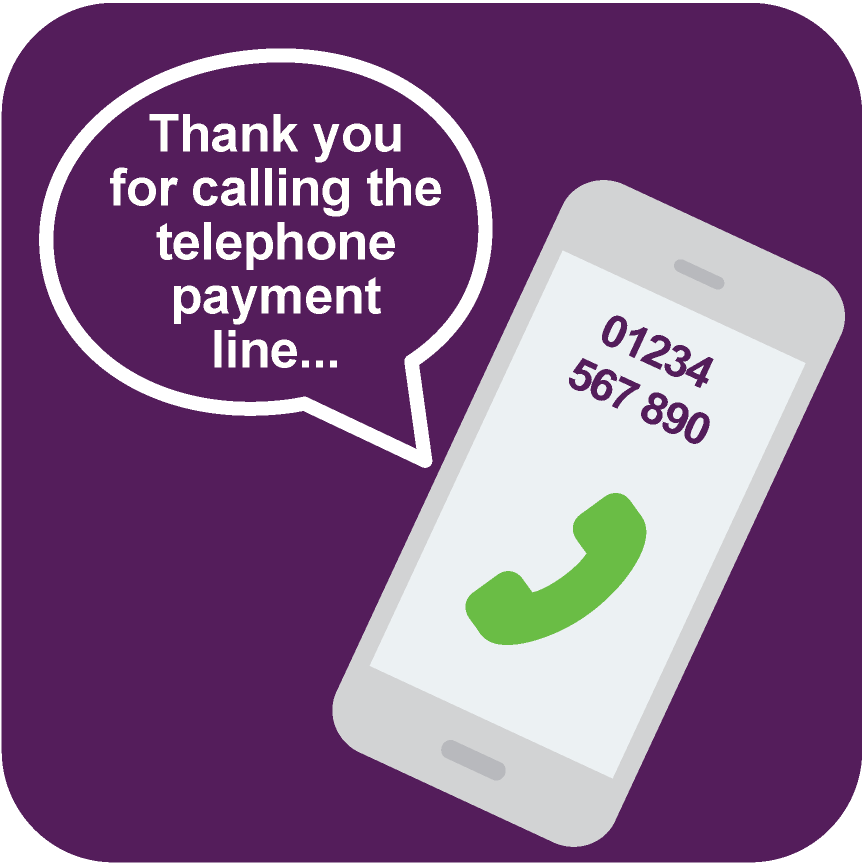

3

Once the customer has entered the amount they wish to pay, they can key in their payment card details using their telephone keypad.

4

The card data is processed by the payment platform & no sensitive information is sent to the organisation.

5

Once the transaction is complete, the customer is informed.

6

The customer is then given the option to be sent an SMS receipt containing confirmation of the payment.

1

The customer calls the organisation to make a payment.

2

The customer is greeted by an automated line which asks a number of security questions. After verifying their identity, they are taken to the payment stage.

3

Once the customer has entered the amount they wish to pay, they can key in their payment card details using their telephone keypad.

4

The card data is processed by the payment platform & no sensitive information is sent to the organisation.

5

Once the transaction is complete, the customer is informed.

6

The customer is then given the option to be sent an SMS receipt containing confirmation of the payment.

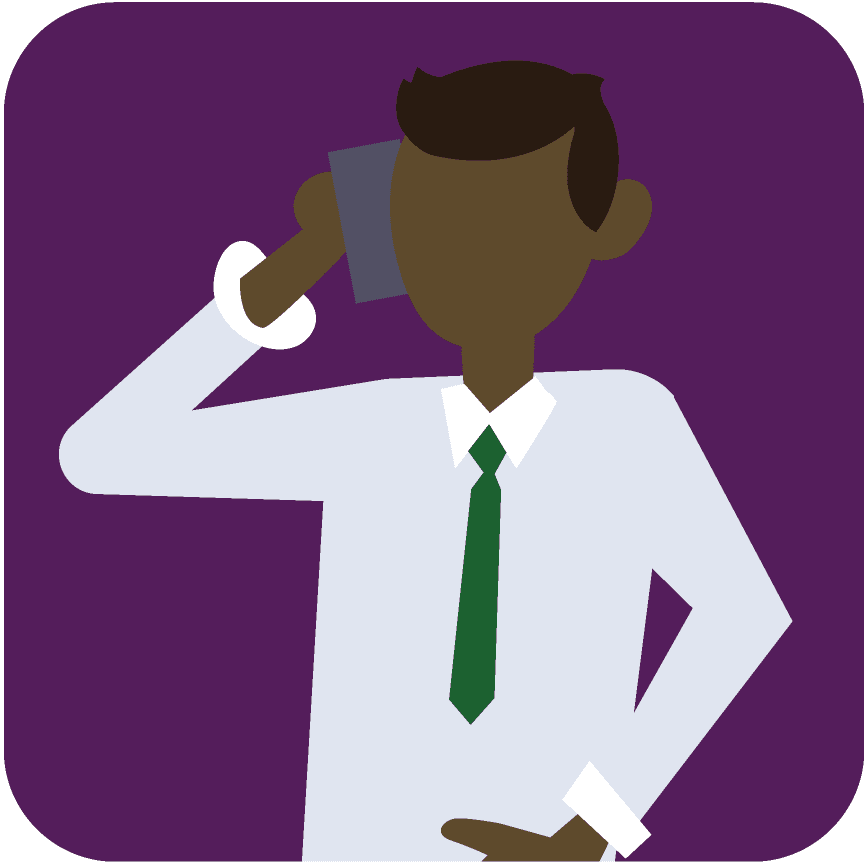

1

The customer is talking to an agent, discussing an order.

2

When they are ready to make a payment the agent can verify the customer and push the order details to the payment line. They then transfer the customer to the payment line. The agent will no longer be in conversation with them.

3

The customer is greeted by the payment IVR which reads out the order details and the amount to pay.

4

The customer can key in their payment card details using their telephone keypad.

5

The card data is processed by the payment platform & no sensitive information is sent to the organisation.

6

Once the transaction is complete, the customer is informed and given the option to be sent an SMS receipt containing confirmation of the payment.

1

The customer is talking to an agent, discussing an order.

2

When they are ready to make a payment the agent can verify the customer and push the order details to the payment line. They then transfer the customer to the payment line. The agent will no longer be in conversation with them.

3

The customer is greeted by the payment IVR which reads out the order details and the amount to pay.

4

The customer can key in their payment card details using their telephone keypad.

5

The card data is processed by the payment platform & no sensitive information is sent to the organisation.

6

Once the transaction is complete, the customer is informed and given the option to be sent an SMS receipt containing confirmation of the payment.

Global legal business seeks security and a 24/7 payments

Kevin Feehan - Director

"We’ve been working with Key IVR for over 7 years now, their systems are so reliable we’re very rarely contacted by someone struggling to use the services. The platform is very straightforward and easy to use."

Kevin Feehan - Director

"We’ve been working with Key IVR for over 7 years now, their systems are so reliable we’re very rarely contacted by someone struggling to use the services. The platform is very straightforward and easy to use."

Global legal business seeks security and a 24/7 payments

Service additions

There are a multitude of additions we provide to suit your bespoke IVR solution.

Your solution can be configured to suit your business needs, all fully secure to the highest level of PCI-DSS compliance.

Secure Voice Recognition

Capturing non-numerical information from your customers on a telephone keypad is impossible. However, it can be important to capture the details have no numbers or a mix of alphanumerics – such as name, postcode, National Insurance number or car registration.

Additionally, using a telephone keypad to input account information or card details can be challenging for some customers, especially for those with a severe physical disability.

To cater for all demographics and information formats, our Payment IVR service can be configured to prompt the customer to speak details out loud, accurately deciphering their answers and progressing to the next step.

Card details are verified and processed securely. The system will mute the call as sensitive details are spoken, so any call recordings are out-of-scope and you remain PCI-DSS compliant.

Automatic Voice Transcription

With this voice to text option, customers can be prompted to speak their details aloud at certain steps. The service will provide this information back to you in a sound file, transcribed text format in Excel or integrated directly to your back office systems via our powerful API.

Powered by world-leading technology, our clients use this for a range of uses; such as logging address information for Charity Gift Aid, or providing comments and feedback at the end of the payment process.

This bypasses the hurdles of manually transcribing details from call recordings, such as data security issues when sensitive details are involved. It can also become expensive and time-consuming when you’re faced with high volumes.

Direct Debit Payments

Add Direct Debit to your payment solution and start securing collections through one of the most trusted channels in the UK.

Set up, modify and monitor Direct Debits simply and conveniently, avoiding the hassle of chasing a multitude of late payments. Options include: payment plans and one-off transactions to collect variable amounts, subscription payments and fixed fees alike.

Tokenisation

Tokenise a customer’s card, meaning they will only need to provide card details once, saving them time on regular payments and purchases.

All payments are secure as card details are not stored anywhere outside the issuing card company, with tokens containing a dedicated reference for every individual customer.

E.g. Policy number, customer number, customer name, phone number, etc.

Recurring Payments

Offer your customers a Recurring Payment Plan with a range of payment frequencies, such as weekly, fortnightly, monthly, etc.

A Recurring Payment Plan / CPA (Continuous Payment Authority) differs from a Direct Debit as you can re-take failed payments, restarting the plan and avoiding expensive failed payment charges.

This method is recommended by the FCA, as debt isn’t added onto customers paying off existing debt.

SFTP Integration

Validate your customer transactions and avoid matching every transaction and investigating human errors.

You’ll have the option to supply customer records or a list of outstanding payments so transactions can be validated as a customer makes a payment.

Bespoke API Integration

Our solutions are compatible with many different APIs, allowing integration with hundreds of different platforms.

If necessary, a bespoke API can be developed to work seamlessly with your business systems.

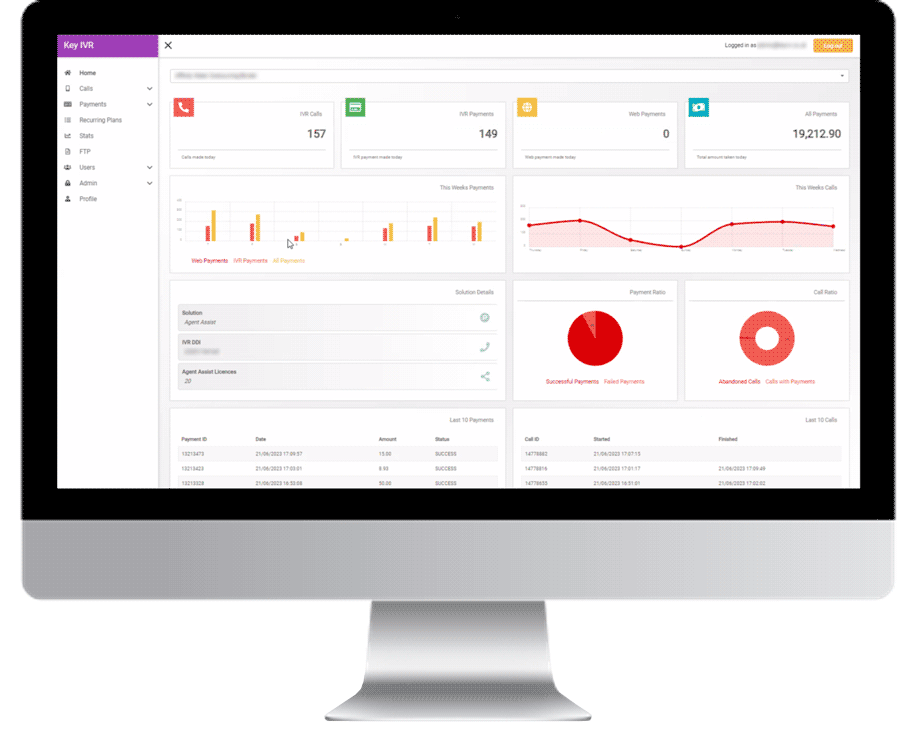

Track payments & activity on your Client Portal

- Real time and historical reporting across all your payment services

- Monitor payment volume, payment status, call volume, call abandonment rate, recurring payment plans, licences and much more

- Download payment and call log reports

- Intuitive and easy to use

- Set user access controls for admins and users with limited control

Submit your details and a payment specialist will be in touch.

Sophie Chan

Head of Account Management

Services that work for everyone, including…

Debt Recovery

Housing

Travel Agents

Charities

Services that work for everyone, including…

Debt Recovery

Housing

Travel Agents

Charities

Contact Centre Teams

Debt Collection & Enforcement

Collection and card processing needs to be fast, reliable and convenient for both debtors and your staff. Whether you take payments on the phone, via an automated IVR, online or in person we can provide a bespoke, PCI-DSS Compliant solution, comprised of payment methods that work seamlessly together

Utility Suppliers & Providers

Travel Agencies & Tour Operators

Our services can be tailored to meet the specific needs of the travel sector, providing a range of payment methods to suit your individual requirements

Property Management & Housing Associations

Managing and maintaining the incoming funds from tenants is a crucial day-to-day process for any housing association, But, keeping track of this can often be tricky, especially when there are many areas to oversee

Charities & Not for Profit

Managing and maintaining the incoming funds from tenants is a crucial day-to-day process for any housing association, But, keeping track of this can often be tricky, especially when there are many areas to oversee

With Key IVR’s PCI-DSS compliant solutions, not for profit organisations can offer their donators the best experience during the fund-raising process – along with protecting their sensitive data